Gm fellow Architects;

Crypto prices are reaching new heights, and the crypto fear and greed index is in the greed territory.

Oh, and Uniswap token holders are having a decentralization Vs. centralization battle.

• Crypto prices are up by 20%

• Uniswap introduced a new swap fee

• Bitcoin is decoupling from stocks

Crypto prices are up by 20%

Uptober is doing it again. Over the last ten trading years, only 2014 and 2018 saw downturns for crypto.

In 2023, even amidst a challenging global background – with peaking interest rates globally and an escalating conflict between Israel-Hamas that threatens larger geopolitical repercussions – crypto prices have generally increased.

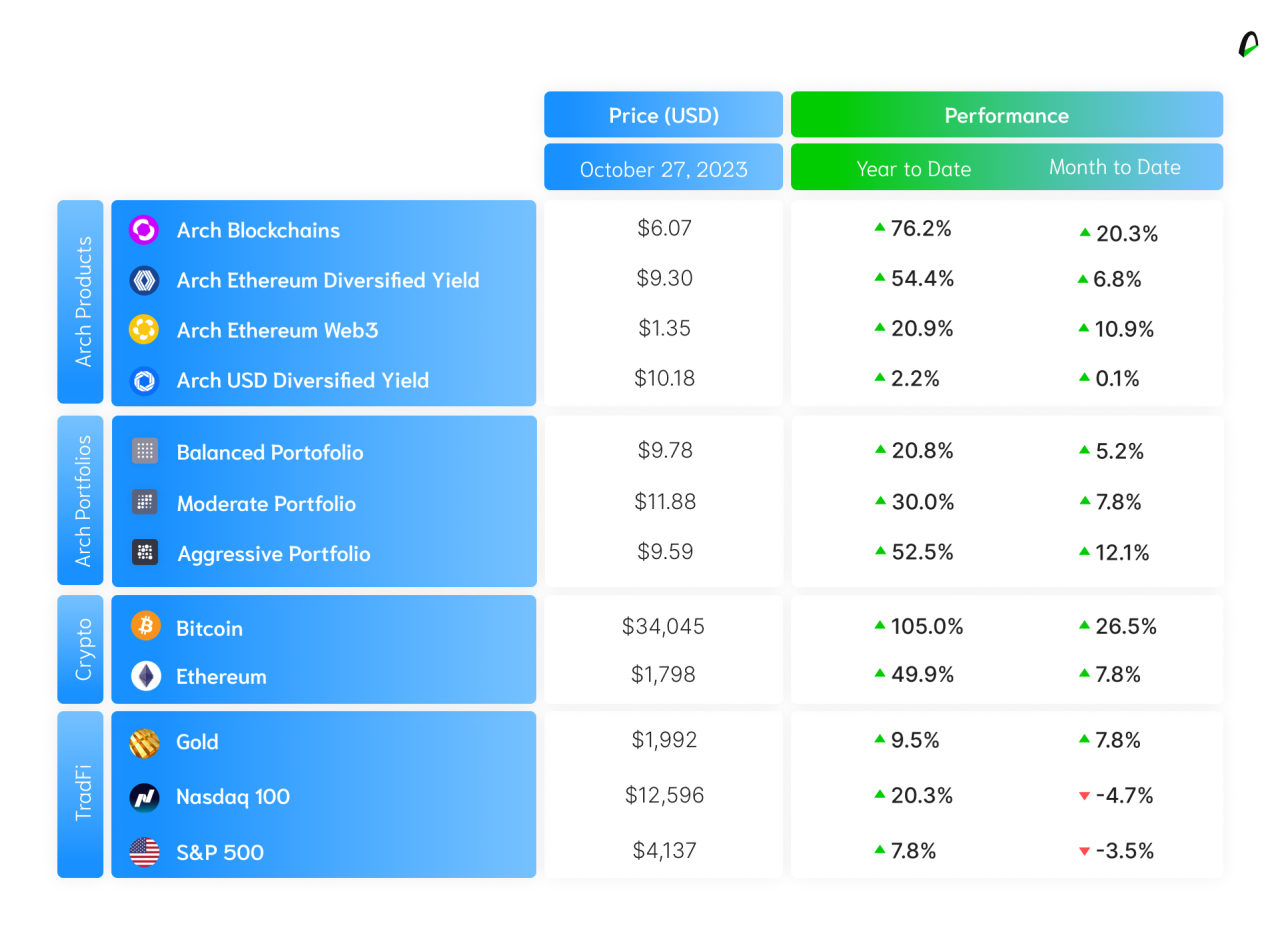

Bitcoin has risen 26.5% this month alone, marking a new annual high at around $35,000. This represents an astonishing +105.0% return year-to-date. Meanwhile, Ethereum, the second-largest cryptocurrency, has posted a 7.8% growth for the month, amounting to 49.9% for the year. The disparity in their recent performances has been a hot topic of debate.

Many attribute the recent surge in Bitcoin's price to the anticipated approval of BlackRock's spot Bitcoin ETF. After all, an SEC approval would signal trust in the asset, suggesting it may be securely included in any institutional balance sheet. No doubt, a very powerful message.

Another theory suggests Bitcoin is mirroring the attributes of digital gold, serving as a refuge asset. This idea gains traction as the world struggles with the potential negative repercussions of an extended Middle East conflict and the costs of financing it in an already high-interest rate environment.

Some investors believe that the strong performances of gold (+7.8% in October) and Bitcoin are responses to these global uncertainties, especially when traditional risk-off assets like US Treasuries are in a historic bear market. In fact, a recent study from BofA highlighted that US Treasuries have lost 24.7% of their value since the lows of Treasury yields in the summer of 2020, in what has been the worst performance for the asset class since the 19th century.

While pinpointing the exact catalyst for the recent crypto rally is impossible, upcoming events may continue to drive positive momentum. Notably, the SEC's final decision on spot ETFs is due in January, followed by the Bitcoin halving event in April.

Arch Blockchains ($CHAIN), our investment product that includes key blockchain protocols like Bitcoin and Ethereum, has risen by +20.3% in October for a 76.2% growth year-to-date. In the traditional risk markets, Nasdaq has retreated by 4.7% so far in the month, (+20.3% for the year) and S&P 500 has declined by 3.5% (+7.8% for the year).

Is this a war between centralized and decentralized Uniswap token holders?

Uniswap, a popular decentralized exchange protocol, recently introduced a new swap fee on their website and wallet. The new fee, set at 15 basis points (0.15%), has already generated significant revenue for Uniswap Labs.

And how much is Uniswap earning with this?

In the first 24 hours since implementing the fee, Uniswap Labs made nearly $84,000, which annualizes to over $30 million.

And the issue is...?

The introduction of the swap fee has raised concerns about governance and highlighted the differences in benefits between investors holding equity in Uniswap Labs and those who hold the governance token UNI.

UNI token holders have long hoped to receive a share of revenue on trades, but the new fee does not directly benefit them.

Tell me more about the market impact

UNI tokens have been down 20.5% year-to-date, compared to a 49.9% increase in ETH. Additionally, UNI is currently trading 90% below its all-time high of $42.4, reached in May 2021.

The drop in token value coupled with the introduction of the fee has left UNI token holders questioning the benefits they will receive.

I see you talking about Uniswap and Uniswap Labs, are they the same?

Not really, there's a distinction between Uniswap Labs and the decentralized Uniswap protocol.

Uniswap Labs is the centralized company behind the development and maintenance of user-facing products like its website and wallet, while the protocol itself is governed by its users and token holders.

The introduction of the swap fee by Uniswap Labs raises questions about the alignment of incentives between the centralized company and the decentralized protocol.

Hmm that makes sense, and what about governance?

The introduction of the swap fee has also raised concerns about governance. Token holders have a vested interest in the long-term success and sustainability of the protocol, but they may be worried about their rights and influence in decision-making processes.

Questions arise: How will Uniswap address the concerns of UNI token holders? Will there be a redistribution of benefits to align with the interests of token holders? How do the governance mechanisms ensure adequate representation and participation among token holders?

As the situation unfolds, it will be crucial for Uniswap to find ways to address the concerns raised and ensure a fair and inclusive governance structure that considers the interests of all stakeholders involved.

📰 Is this the time to buy? According to the Fear and Greed Index, yes.

⏱ If you only have time for the quick and dirty

- Crypto fear and greed index reaches new heights

- JPMorgan is having a great time with their crypto payment system

☕️ If you want the full scoop

🤑 About the crypto fear and greed index reaching new heights: In the crypto space, there's a metric known as the Fear & Greed Index. It's a barometer of sorts, measuring the emotional climate of the market. Think of it as a sentiment thermometer for crypto investors.

This tool gauges the emotional state of the crypto market, tracking factors like volatility, market momentum, and social media activity, to give us a sense of whether investors are feeling confident (greed) or fearful (you guessed it, fear) about the state of crypto affairs.

This month, that index has skyrocketed to its highest point (72) since November 2021. What's that mean? Well, if we were to describe the current sentiment in the crypto space, it's definitely leaning toward "greed."

⛓ About JPMorgan using blockchain: According to Takis Georgakopoulos, the company's global head of payments, they are processing a substantial daily volume of $1 billion through JPM Coin for several large companies. JPM Coin operates as a permissioned blockchain-based payment system, providing the bank's wholesale clients with a means to transfer U.S. dollars and euros. It operates around the clock, enabling faster transactions and better liquidity management for clients

📺 Look mom, we’re on the news!

Talking about Bitcoin price reaching new heights

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice