Is this what a crypto Spring feels like? Bitcoin and Ethereum are rising, and the Argentine election opens up new crypto possibilities.

In the past two weeks, we've seen inflows, governments using blockchain on their debt market, the SEC meeting with big players to discuss ETFs, and a Binance saga.

• Why is the Argentine election sparking excitement within the crypto community?

• This might be what a crypto Spring feels like.

• What you need to know about the Binance saga and the SEC conversations.

New Argentine government opens new possibilities for crypto

Last Sunday, Javier Milei was elected as the new president of Argentina, the third-largest economy in Latin America. This development has sparked considerable excitement within the crypto community.

Electors voted, and the liberal agenda won.- But why does it affect crypto so much?

The crypto community, locally and globally, has received Milei's victory with optimism. High-profile figures like Coinbase CEO Brian Armstrong have even suggested collaboration.

During his campaign, Milei has spoken very supportively about crypto assets, and in such a moment, referred to Bitcoin as a representation of the "return of money to its original creator, the private sector.”

In the same vein, the new cabinet's chancellor, economist Diana Mondino, has made bold declarations in favor of the freedom of crypto use: “The proposal has always been and will always be freedom of currencies. Let those who want to make contracts in Bitcoin do it.”

What was the stance of the previous government?

Less friendly. This stance marks a significant pivot from the departing government's restrictive policies on crypto, which included a ban on bank operations with crypto firms in 2021 and a complete prohibition on offering digital wallets and cryptoasset assets by any company in May 2023.

Currently, Argentines face stringent limits on foreign currency purchases, being allowed to legally buy only $200 per month for savings and being constrained to save any excess in its local currency - entirely pointless in a country where the inflation rate is in triple digits (hovering at 140% for the past year).

Without legal access to solid currencies, the black market of physical currencies dominates, increasing transaction costs and adding safety risks and custodial concerns to the equation.

And this is when crypto enters the space?

Right. The emergence of crypto stablecoins offered a completely different panorama. Being decentralized, censorship-resistant, and with a 24-hour live market, it provides an efficient and effective solution for anyone to refugee from its local economic instability.

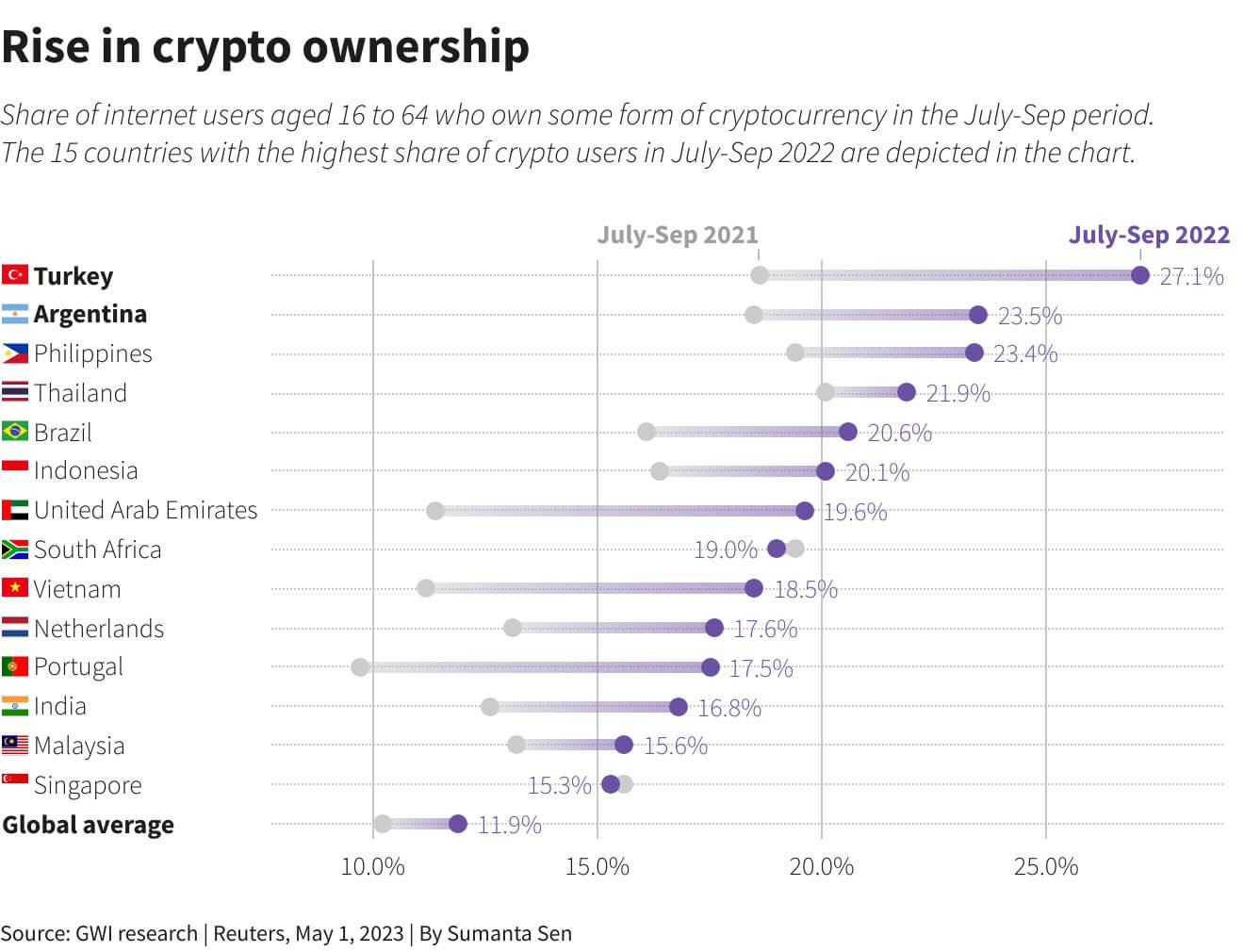

In fact, and despite bans and prohibitions, the advantages of crypto to hedge against monetary debase haven't gone unnoticed.

It is estimated that 23% of the 48 million people in Argentina already hold crypto assets (that compares to the 11.9% average worldwide, according to GWI). It is a significant proportion but could grow even more with the new government perspectives.

Tell me more about Milei's proposal

Milei's main proposal for the dollarization of the economy would be a simple formality since most Argentines already maintain their wealth in dollar bills (physical dollars in Argentina far exceed physical pesos in value). Even big purchases like real estate are usually quoted and paid for with bundles of dollars.

What can be a game changer for the crypto industry in Argentina is the government's support to make digital currency a reality with which anyone (citizens and companies) can freely interact, making better use of it.

While accomplishing its campaign promises (i.e., exchanging the peso for dollars) may prove more complex than expected, liberalizing crypto activities and granting citizens the freedom to use them could effectively address numerous economic burdens faced by Argentines.

Argentina elections are another example of crypto becoming a more significant talking point in the global political landscape.

Interesting, how can I take advantage of that?

In Arch, we see a lot of value in using stablecoins to strategically shift exposure in and out of crypto markets and, as described above, as a hedge against local currency turmoil.

The Arch USD Diversified Yield ($ADDY) offers a transparent, liquid, and accessible vehicle to gain exposure to USD while compounding on yields of 2-3% per annum.

Bye-bye, crypto Winter. Hello crypto Spring

Can you feel the smell of crypto Spring? November is close to an end, and the momentum for crypto assets remains.

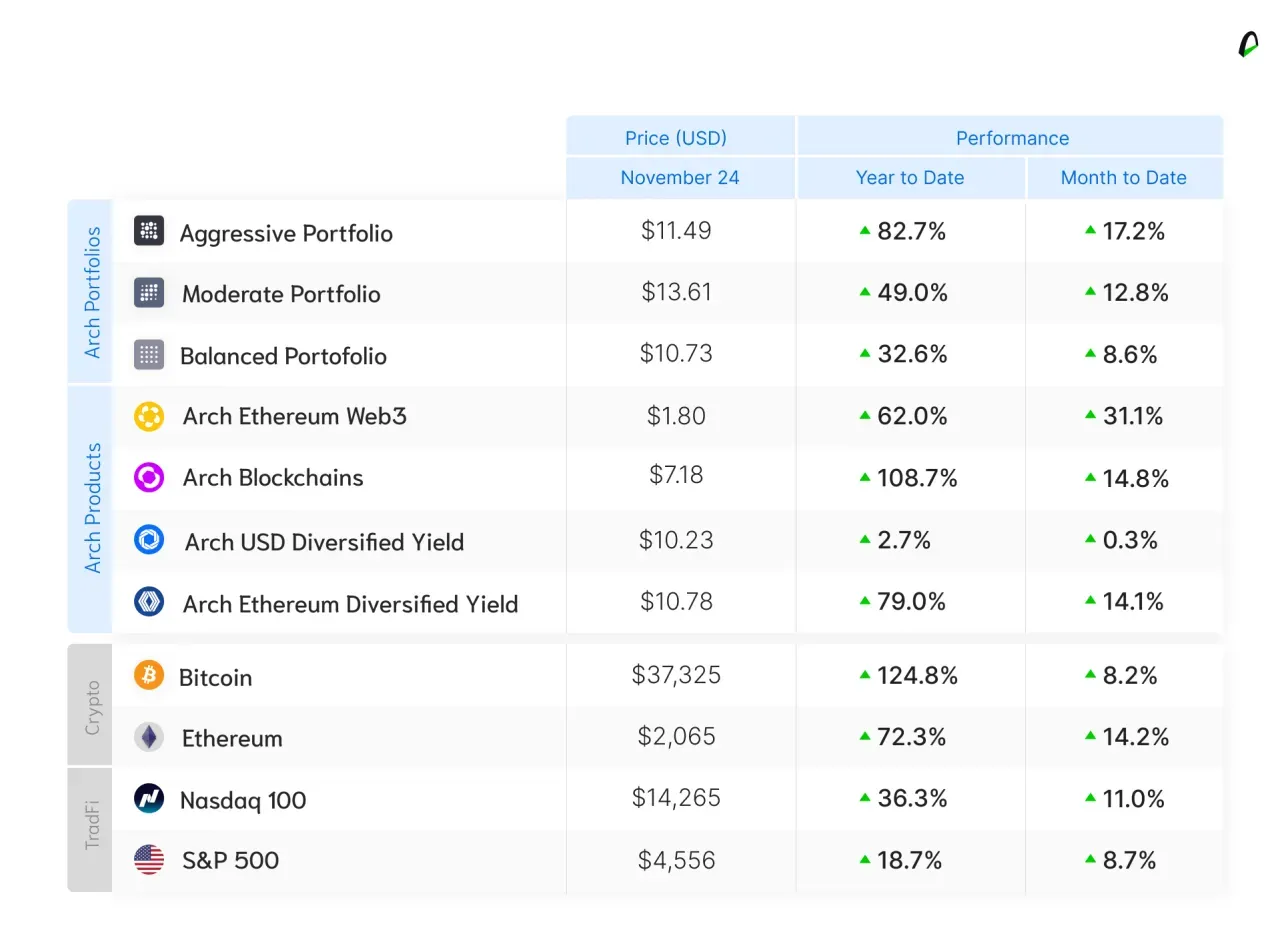

Bitcoin and Ethereum have been traded at their highest level for the past 18 months, at around $38,000, and $2,100, respectively.

Performance year-to-date accumulated 124.8% for Bitcoin and 72.3% for Ethereum. The Arch Blockchains - our investment product that includes both assets besides Solana and Matic - has shown a 108.7% increase in 2023.

Traditional risky indices have also posted gains. The S&P500 reached 8.7% in November, while Nasdaq rose 11.0%.

The reasons for general optimism have much to do with the deceleration of indicators in the real economy. During November we witnessed weak numbers for inflation, employment, and industrial production in the U.S., followed by a Fed read-through that the economy is cooling down.

That was enough for markets to incorporate no further rate hikes and anticipate expected reductions for May-2024. The 10-year interest curve closed 35bps to 4.42% and further fueled risky markets like stocks and crypto.

📰 Everybody loves crypto

⏱ If you only have time for the quick and dirty

- The SEC is having meetings with firms to talk about the Bitcoin ETF

- Binance CEO is stepping down. They got fined. Money is leaving the exchange.

- Money is flowing into crypto.

- Phillipiness is using blockchain to sell government bonds.

☕️ If you want the full scoop

👩⚖️ About the SEC in conversations for the Bitcoin ETF: James Seyffart, a Bloomberg Intelligence analyst and go-to guy for all things Exchange Traded Funds (ETFs), is back at it again.

According to his reporting, the SEC is deep in discussions with industry giants like Grayscale, BlackRock, and NASDAQ. What's on the table? A spot Bitcoin ETF. It's not a question of "if," but "when," according to the whispers in the financial corridors.

🚨 About the Binance saga: After years of investigation, the U.S. government and Binance have finally reached a settlement. Changpeng Zhao (CZ), Binance's CEO, has stepped down after this prolonged ordeal. CZ has pled guilty to money laundering violations, potentially facing up to 18 months behind bars. And Binance is on the hook for ~$4.3 billion in fines. This marks the most significant penalty in U.S. Treasury history.

In the wake of CZ's departure and Binance's hefty fines, the exchange has witnessed a jaw-dropping $1.2 billion in net outflows in just 24 hours. Meanwhile, other exchanges like OKX and Kraken are seeing a net influx.

💸 About crypto inflows: Every week, CoinShares reveals how much money is flowing into digital asset investment products. Last week, the crypto investment scene saw a robust $176 million in inflows. Year-to-date inflows have stacked up to an impressive $1.32 billion. Tthis marks the eighth consecutive week of inflows.

And why does all this matter? According to the analysts over at CoinShares, the continued positive sentiment is building up to the imminent approval of a spot Bitcoin ETF in the U.S.

🇵🇭 About the Philippines using blockchain: The Philippines is gearing up for a groundbreaking move in finance. They are launching tokenized treasury bond sale, set to kick off next week, with the Bureau of the Treasury eyeing a minimum target of 10 billion pesos ($180 million).

In a stride towards the future, the Philippines government is stepping into blockchain technology to digitize its domestic debt market. This move aligns with a growing trend where governments worldwide are exploring the potential of blockchain for financial innovation.

I'm just writing to you: The opinions expressed are for general informational purposes only and are not meant to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.