GM Architects,

This week once more brought turbulence to the financial markets, spreading into crypto. The Arch Ethereum Web3 token ($WEB3) fell by 4%, clocking its best week in over a month.

Crypto and Tradfi Overview

The Fed reassured investors that an aggressive hike in interest rates was not an option. However, Wall Street continues to plunge. The S&P500 and Nasdaq head to the seventh-week losing streak, the longest in more than two decades. Wednesday was the worst one-day loss for the S&P 500 and Dow Jones Industrial Average since June 2020.

In crypto, Bitcoin slid 3.2% since Sunday and also entered a seven-week losing stretch. Nonetheless, BTC is currently trading at $28.995 above the $24.000 it traded at last week, showing a slight recovery after the UST carnage. Bitcoin options trading suggests Wall Street's bearish sentiment is spreading to crypto, increasing correlation across asset classes.

📬 Like this weekly recap?

Every Friday we send a weekly recap about the Web3 ecosystem and how crypto markets, and markets in general, are moving. Share and subscribe!

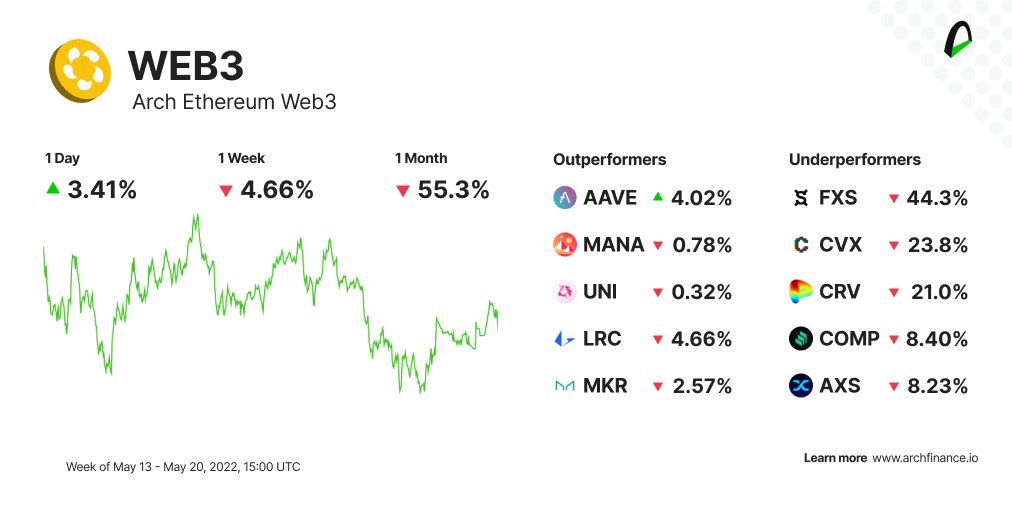

📉 Web3's performance stabilizes

The Arch Ethereum Web3 token is showing some stabilization after last week.

- AAVE was the outperformer being the only token trading on the green during the last seven days. This comes after the launch of the Lens Protocol, an open-source tech stack that will allow developers to create decentralized applications that support social networking. Creators can now mint their social profiles and be in control of their social data.

- Decentraland (MANA) also showed a slight spike after MegaCube 2 launched on the MANA network. MegaCube 2 is a mining game that features 100 layers representing NFTs.

- Uniswap's (UNI) price increased more than 7% in the last 24 hours after feeling intense selling pressure over the last couple of weeks.

- FraxShare (FXS) continues to feel Terra's crash. Having a significant part of its treasury tied in UST, the protocol is now trading over 44% lower than last week.

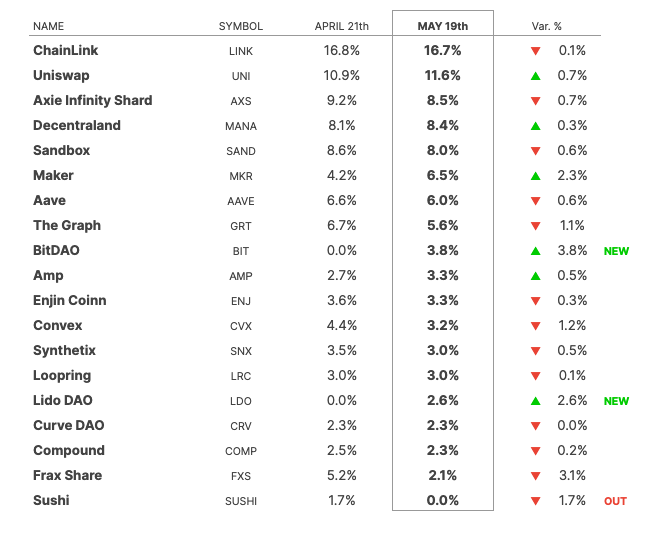

Arch Ethereum Web3 Token rebalanced

On May 19th, the Web3 token updated its composition, following it rebalancing guidelines:

Here are the changes in constituents:

- Included BitDAO. BitDAO is one of the largest decentralized autonomous organizations looking to drive the development of tools and technologies that power up the Web3 ecosystem. BIT is the governance token behind the project and allows users to vote and participate in the organization's decisions.

- Included Lido. LidoDAO (LDO) is an Ethereum liquid staking solution and is the market leader, having over 80% of the market share in that space. It allows users to stake their ETH without minimums.

- SushiSwap (SUSHI) left the token.

Learn more about MANA and Decentraland

Decentraland (MANA) is a decentralized virtual reality universe powered by the Ethereum blockchain. Within the platform, users can create, experience, and monetize their content and the apps they make.

--> 📚🤓 Take a deep dive into Decentraland and the MANA token part of the Arch Ethereum Web3 Token.

👁️🗨️ Become a beta tester

Be an essential part of Arch's development. We want to hear your feedback about a new prototype we are testing. Let's meet!

- $WEB3 holders - Verify your assets to access the exclusive #architects-lounge channel.

- 🐦 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- ⚠️ Important: beware of scams, and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

💼 Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.