If you've spent any significant time in crypto, you've probably heard of wrapped tokens, or maybe you've traded wrapped Ether (wETH) or wrapped Bitcoin (wBTC), without really giving the 'w' in their symbol a second thought. Wrapped tokens are everywhere, even as constituents of the Arch Blockchains token (CHAIN)

But what is a wrapped token exactly? Let's use an amusement park analogy.

Imagine that you have dollars in your wallet and want to have fun at the amusement park.

At the gate, they tell you that within the park, you can only use "tickets" to pay for rides and food, not your regular money, so you exchange your dollars at the box office for their corresponding value in tickets: 1 ticket = 1 dollar.

After spending the afternoon using your tickets, you head to the gate and exchange back your remaining tickets for dollars.

Now, let's see how this analogy plays out in crypto: the dollars would be a native token like ETH, and the amusement park tickets would be a wrapped token like wETH.

The box office becomes the wrap "custodians" (platforms managed by smart contracts where you deposit your ETH and they release the equivalent in wETH). Just like when leaving the park, you can recover 'un-wrapped' ETH later, by bringing the wrapped tokens back to the custodian.

Notice how you are never really altering the original asset in any way; you are just exchanging it for something else.

And why would you want a token that is not the "original" one? There are mainly two reasons:

- Use ETH to interact with Dapps: many decentralized platforms and Dapps can only trade ERC-20 tokens; however, ETH is not an ERC-20 token itself (as it was created two years before the standard was adopted in 2017)

- Use cryptos outside their native networks: If you have bought NFTs on the Polygon blockchain at OpenSea, you will surely have used "ETH Polygon." This token has the same value as ETH but operates on a network other than Ethereum (in this case Polygon).

This gives cryptos more interoperability and creates a more robust landscape where participants can interact with different networks.

If we talk about wrapped tokens, not only does wETH exist, but almost all cryptocurrencies present their wrapped version.

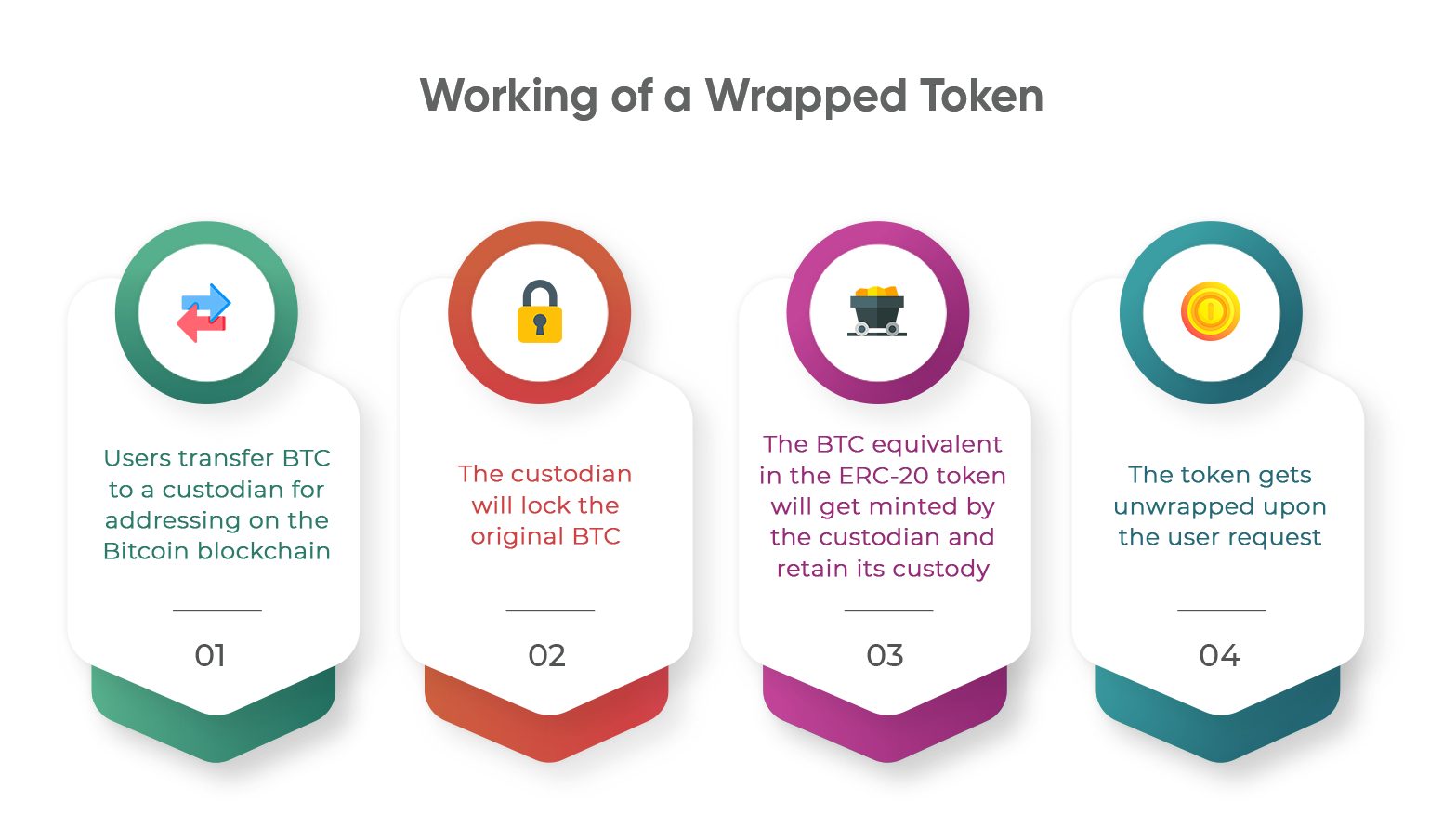

How do wrapped tokens work

Wrapped tokens are minted on a blockchain after the required number of "real" tokens are sent to a custodial wallet.

For example, if a user wants to convert Bitcoin into wrapped Bitcoin, he'll have to send the exact amount of Bitcoin to be converted to the custodian's wallet. Once this is done, the custodian locks the Bitcoin in a vault and, in turn, mints wBTC.

Users might wonder how wrapped tokens are returned to their original state. This is done through the same process that the custodians converted them in the first place.

This means that the custodian has to release the Bitcoin stored in the vault, showing that each wrapped Bitcoin has an equivalent value on Bitcoin.

Again, think of it as the box office holding your dollars while you have a nice afternoon using tickets at the amusement park.

Some of the most common wrapped tokens

Since the inception of wrapped tokens, some high-value tokens have taken their place in the top stack. Below are examples of wrapped tokens on the market;

Wrapped Bitcoin

The development of wrapped Bitcoin first came to media attention in 2018 but was subsequently launched in January 2019. Wrapped Bitcoin is a tokenized digital asset available on the Ethereum blockchain. It uses the ERC-20, Ethereum's unique standard for its token.

Users can use the asset in different parts of the Ethereum ecosystem.

Wrapped Bitcoin is also available for use on decentralized exchanges. As mentioned above, Wrapped Bitcoin maintains the same price as Bitcoin.

Wrapped Ethereum

Ox Labs created and released Wrapped Ethereum in 2017. While wBTC was designed to be used on other blockchains, wrapped Ethereum was made for internal use on the Ethereum network.

One of the most notable features of wETH is that it converts Ethereum into an ERC-20 token. This makes it usable on most DeFi protocols on the network, allowing users to exchange and use the token for services through all the features offered by the Ethereum ecosystem.

Understanding the risks and rewards of wrapped assets

Technological risks are compounded when using wrapped assets. Since wrapped assets can work on another blockchain, they are also subjected to all the risks of that second chain.

For example, while Bitcoin is only exposed to the risks of the Bitcoin blockchain, wBTC is exposed to the risks of the Bitcoin blockchain plus the risks of the Ethereum blockchain.

Similarly, another of the principal risks of using wrapped assets is the need to trust a custodian who has possession of the "real" asset.

Hacking and vulnerabilities when both networks are communicating are risks that developers and traders need to keep in mind when operating with these types of assets.

However, the implementation of wrapped assets also has some significant advantages. Not only do they allow users to participate in other protocols but also come with some network security benefits.

Implementing wrapped tokens reduces the risks of making changes to the original blockchain while still having interoperability capabilities.

For example, if some unknown or unexpected situation were to occur with wBTC on the Ethereum network, the original Bitcoin blockchain would not be affected. The BTC that has not been blocked would not suffer any damage or harm. In this case, only funds locked in custodians or other non-Bitcoin platforms would be affected.

Advantages of wrapped tokens

- Interoperability: allows the use of non-native tokens on other blockchains.

- Increased transaction speed: ensures fast trading.

- Liquidity: increases the efficiency of capital and the availability of liquidity for exchanges, offering investors more trading options

- Lower transaction fees.

Disadvantages of wrapped tokens

- Reliance on a custodian: because such an intermediary is needed, it must be reliable, and users must trust a third party.

- Centralized: because custodian issues wrapped assets, they are prone to centralization.

- Minting costs: this process can be pretty expensive due to large commissions.

- Tech risks: there's the compounded tech risk and the possibility of issues with the smart contracts using during the wrapping and unwrapping part.

Bridges: Another alternative to wrapped assets

Wrapped tokens are not the only way to make cryptos available to different blockchains, bridges are also an option.

Blockchain bridges are interconnected links that allow communication and interaction between two blockchain networks. By linking two blockchain networks, blockchain bridges help Dapps take advantage of both systems, rather than just their host platform.

Blockchain bridges can transfer any data, information, and tokens between two blockchain platforms. Blockchain bridges typically follow the mint-and-burn protocol, meaning token transfers don't take place literally. When a token is transferred from one blockchain to another, it's burned on the first and minted on the other.

Bridges to Polygon, for example, allow assets to be brought from Ethereum and traded on Polygon at lower cost and higher speed.

And while names are different, it's essential to understand that wrapped assets behave similarly to bridges, meaning the risk of exploits that bridges have is also present on wrapped assets.

Closing thoughts

Wrapped tokens allow more interoperability between different blockchains, allowing an asset issued on one blockchain to operate on another.

These make crypto capital more efficient, and available liquidity increases. They also ensure faster transactions. However minting these tokens comes at the cost of decentralization, making the users trust a third party.