Welcome fellow Architects!

In this -the first- issue of our newsletter, we discuss the recent ETH selloff and provide some hope for those looking for a speedy recovery. We also share the latest on the Arch Ethereum Web3 token $WEB3.

Let us know what you think. Join our Discord or DM us on Twitter.

Latest from Arch

Arch Ethereum Web3 Token ($WEB3) is now available on Polygon

Arch Ethereum Web3 token is now available for trading on Polygon dexes. Consider this network if you're concerned about mainnet fees.

The Arch Ethereum Web3 token tracks the returns of the Ethereum Web3 Index, a broad gauge of the web3 ecosystem. The $WEB3 token provides market-weighted exposure to the entire decentralized economy, helping investors diversify their portfolios with one asset.

Arch Ethereum Web3 token

The Arch Ethereum Web3 gives the broadest exposure to the Ethereum Web3 ecosystem. Its constituents cover roughly 70% of the total market capitalization.

Market intelligence

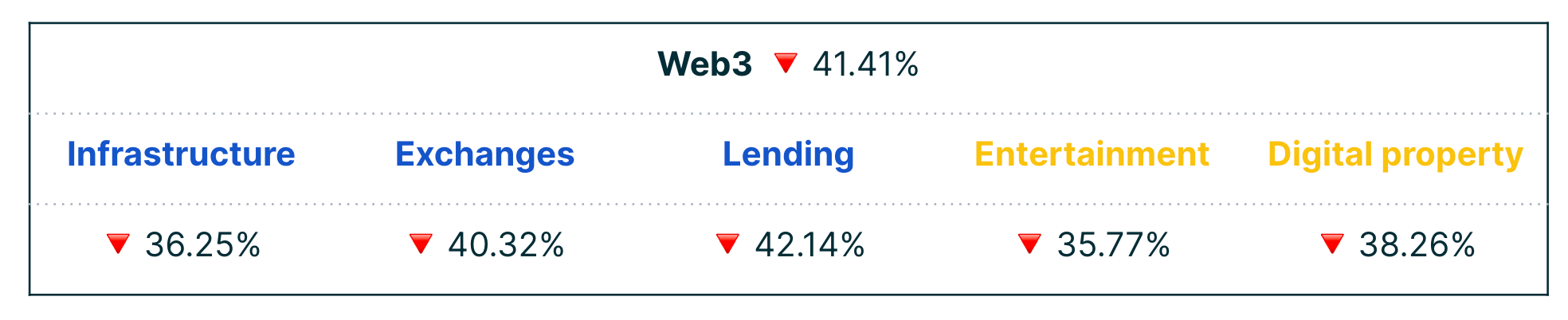

🔻Web3 is down 41% in last 30 days

The Web3 ecosystem is down just over 40% in the past month, compared with $ETH's 30% decline. The slump is led by lenders, which are down 42%, followed by exchanges. Entertainment, which includes metaverse related tokens like Decentraland ($MANA) and Axie Infinity ($AXS), is outperforming, thought still down by 36%. Learn more on Arch Intelligence.

🔻DeFi 2.0 tokens in free-fall

As it has been widely reported, so called DeFi 2.0 have suffered the brunt of this market correction. Olympus ($OHM) leads the Arch Ethereum Web3 Index charts with a 83.64% drop in the last 30 days (and a whopping 96% from its ATH), Abracadabra's ($SPELL) follows not to far down with a 63.05% decline.

💎 🙌 ETH may be back before July, data suggests

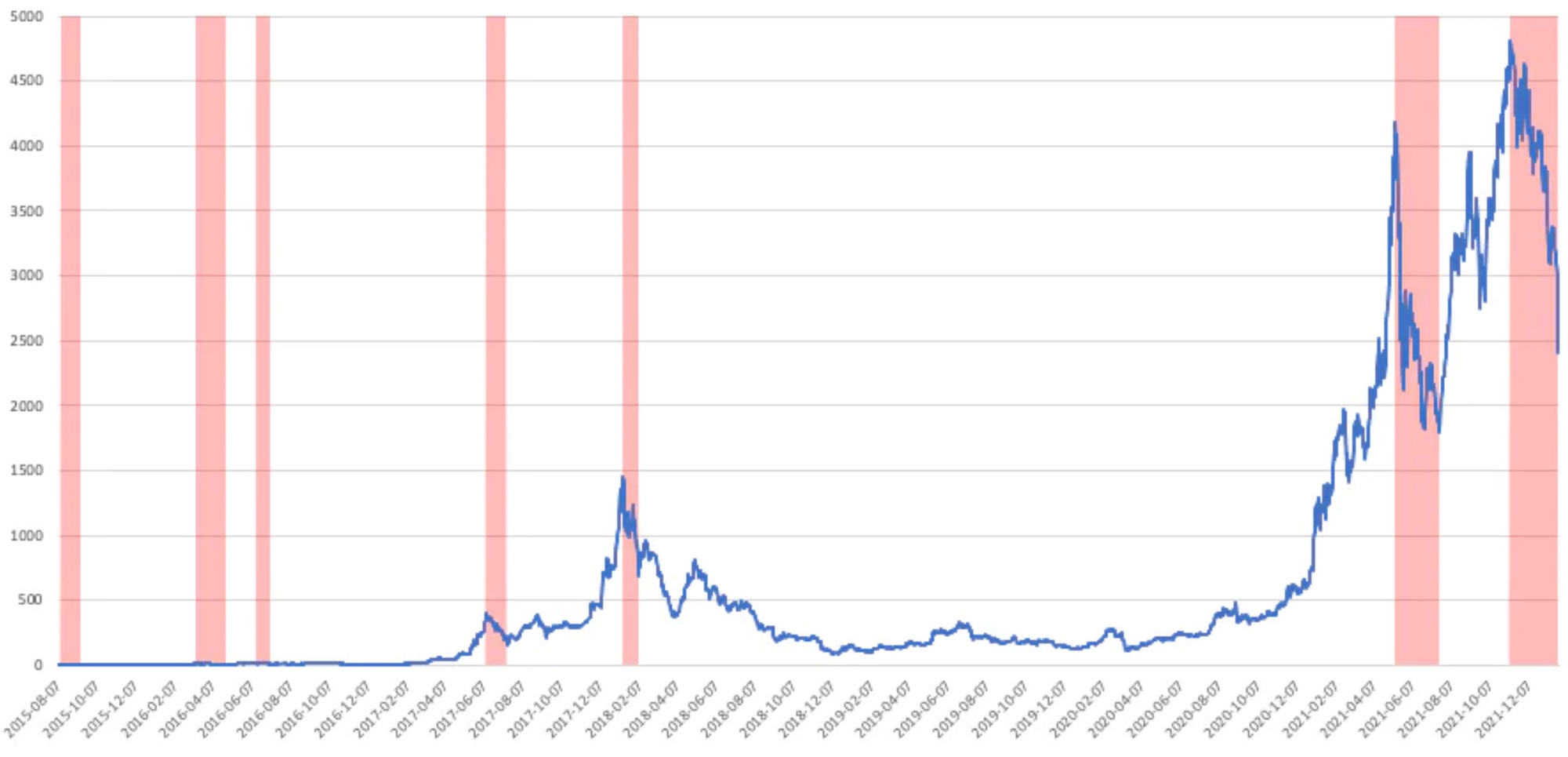

On Friday January 25th, $ETH reached $2,405, a 50% drop against its ATH of $4,812 on November 7, 2021. This corresponds to a loss of more than $280B in market capitalization, the largest in the token’s history.

However, such massive sways are not new for this cryptocurrency. Ethereum has dropped 50% or more from its ATH seven times in the past.

Let’s dive in:

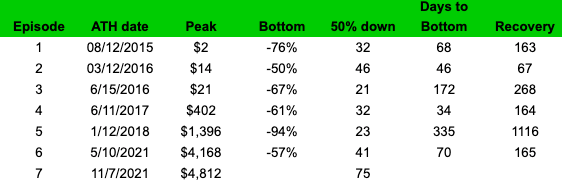

The most salient shared feature of these episodes is how quickly they unfold. On average, the median to a 50% drop in value from ATH is 38 days, the fastest taking place in June 2016, where the price of $ETH went from $20.59 to $10.11 in just 21 days. While spectacular and painful, the current drop has been the slowest in history and only occurred 75 days after the maximum value in November.

Recovery takes longer, excluding the 2018 ‘crypto winter’ episode in which it took $ETH 3 full years to surpass its previous ATH, the median is 165 days. For the hopeful, during the March 2016 episode recovery took only 67 days.

How far down can things still go? $ETH went down 94% (ouch 😰) of its ATH during the 2018 crypto winter, going from $1,396 to $84 in the year 2018, to just 50% during the March 2016 event, before quickly rebounding (as mentioned above).

What should we expect? Ethereum (and broader crypto ecosystem) looks very different from what it did back in 2016-2018, but if history is any indication and barring a new glacial period like 2018, we could see prices back in the $4,000s as early as July 2022.

In a follow-up column, we’ll dive into the internal and external forces at play in this episode.

Community

📣 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and product announcements

- $WEB3 holders — Verify their assets to get access to the exclusive #architects-lounge channel.

- ⚠️ Important: beware of scams and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

👩💻 Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change at any time without notice.