GM Architects,

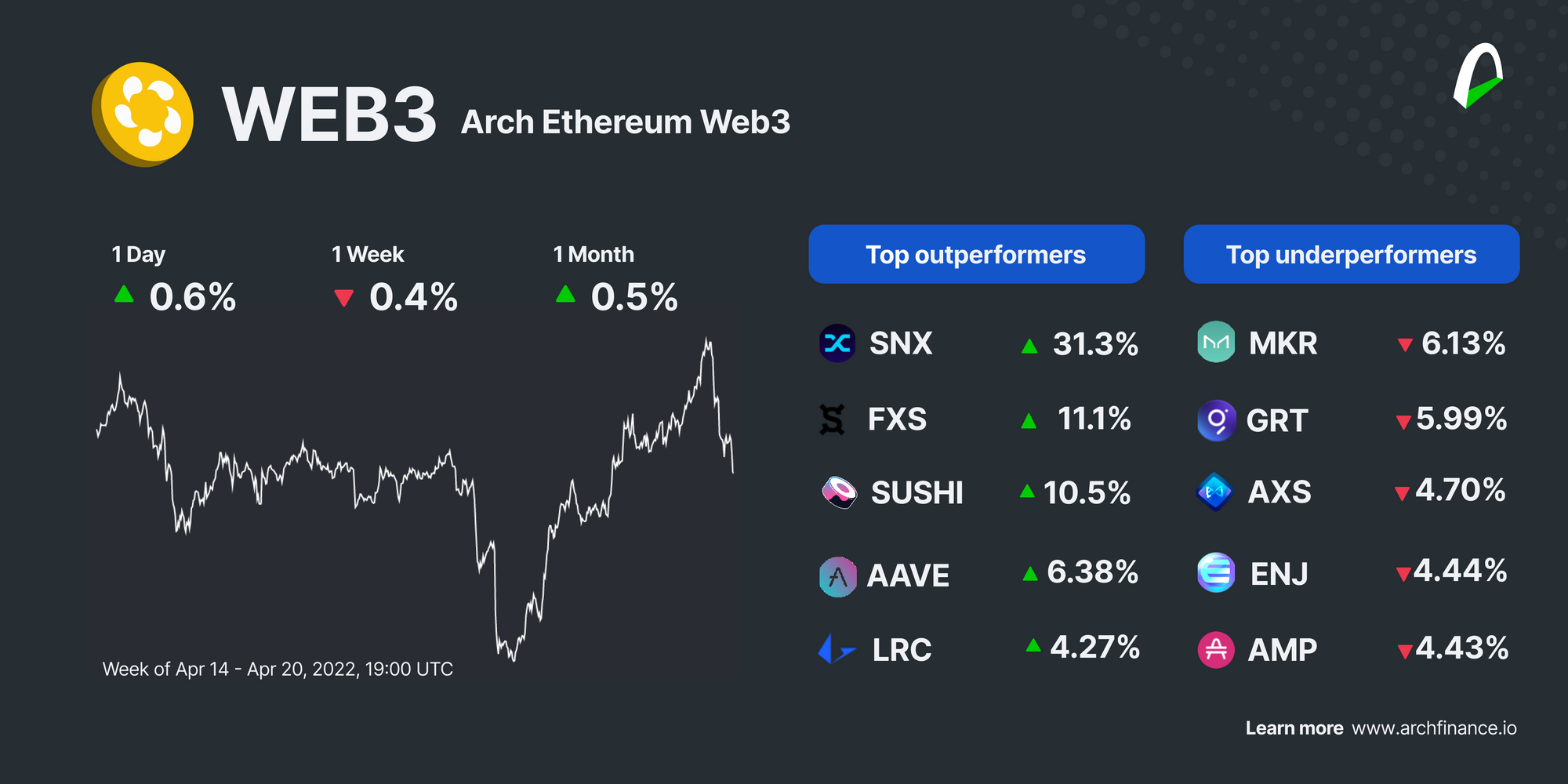

Following last week's 11% correction, the Web3 token experienced sideways action leading to a sharp drop of 9% on Monday. We have since we seen positive momentum build up, ending this 7-day period with flat returns.

DeFi tokens led in terms of performance, particularly Synthetix (SNX) and Frax Share (FXS), which traded 31% and 11% above last week, following new product announcements.

These favorable developments were not enough to outperform Ethereum (ETH), which rose by a similarly unimpressive 1.3%.

Stay tuned for more market and product updates coming soon 👀.

📈 Synthetix Soars 31% on New Product Annoucements

- Synthetix Network Token (SNX) is growing by leaps and bounds. Last week investors doubted its long-term price stability after being pushed out of the Grayscale portfolio. SNX proved investors wrong with a price increase of 31% in the last seven days. This comes after the announcement of perpetual futures, allowing investors to trade with 10X leverage on assets like SOL, MATIC, and even gold and silver. SNX is also part of the Arch Derivatives Index.

- Frax Share (FXS) keeps on a bullish trend, trading over 11% above the last week. Frax announced the launch of their Frax Price Index (FPI) token, the first token to track the U.S Consumer Price Index using oracle data from Chainlink. FXS is part of the Arch Lending Index.

- AAVE jumped over 6% in the last seven days and over 10% in the previous 24 hours after liquidity mining through its latest version went live on Avalanche. AAVE is also part of the Arch Lending Index.

- Loopring (LRC) has shown signs of recovery in the last couple of weeks after a steady decline in popularity. With a bullish sentiment and a trading volume 24% higher than the previous 24 hours, LRC is powering the GameStop NFT marketplace. Loopring is part of the Arch Exchange Index.

- On the other hand, Maker (MKR) has been having a rough week, trading 6.1% down vs. the previous week. MKR is part of the Arch Lending Index.

- Enjin Coin (EJN) is trading 4% below last week. However, the movements have been primarily flat, giving the impression this might be an adjustment after a month of trading on the green. EJN is part of the Arch Digital Property Index.

👁️🗨️ Become a beta tester

Be an essential part of Arch's development. We want to hear your feedback about a new prototype we are testing. Let's meet!

- $WEB3 holders - Verify your assets to access the exclusive #architects-lounge channel.

- 🐦 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- ⚠️ Important: beware of scams, and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

💼 Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.