The golden rule in investing is always to buy low and sell high. The momentum strategy takes this rule further and profits by buying high and selling at even higher.

What is a momentum investing strategy?

Momentum investing is a trading strategy in which investors buy rising securities and sell them when they look to have peaked. The goal is to work with volatility by finding buying opportunities in short-term uptrends and then selling when the securities start to lose momentum.

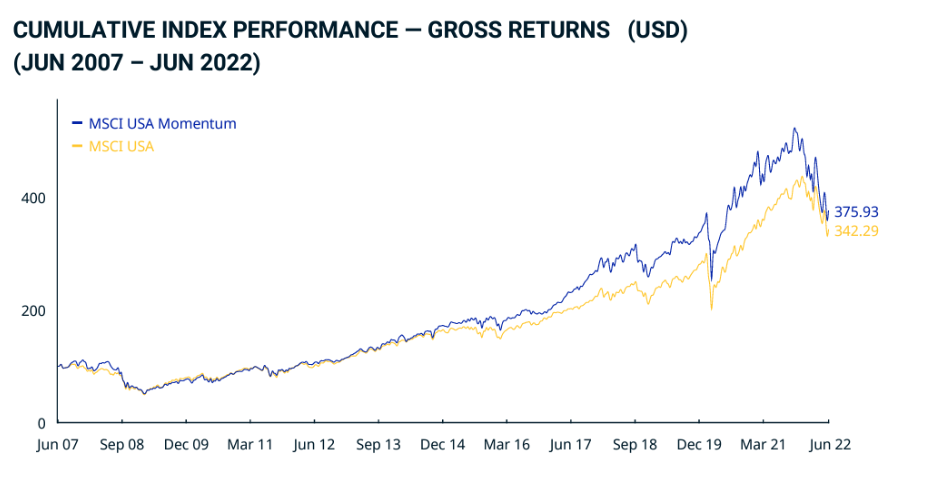

Though momentum was first introduced in the 19th century, it gained popularity during the past three decades and remains an effective strategy. MSCI’s recent report shows that the momentum factor has been one of the most robust generators of excess returns.

To bring momentum investing to the general public, indexes, and ETFs based on momentum strategy have been introduced over the past decade. One example is MSCI USA Momentum Index, which indicates that momentum can yield an excess return over the market cap-weighted index.

However, momentum tends to work the best in medium terms (3 months – 12 months) because market trends may change and work against previously discovered momentum. Many researchers have found reverse momentum instead of regular momentum effective in the long run.

Migrating momentum strategy to the crypto market, the compelling territory of momentum strategy is smaller, and it quickly gets overwhelmed by reverse momentum as the holding period increases.

As a more volatile market, crypto tends to turn its tide more frequently than the traditional financial market.

Therefore, it is necessary to have a more frequent rebalancing to react to the trend changes quickly or to pair a less periodic rebalancing with reverse momentum to make proactive adjustments.

Numerous researchers have discovered this reverse momentum concept. For example, in the paper ‘Cryptocurrency Momentum and Reversal,’ Dobrynskaya found that for sorting and holding periods up to 2 weeks, momentum returns are positive and statistically significant; for 2-4 weeks, it’s insignificant; and for four weeks up to 2 years, significant reverse momentum return, and this return monotonically increases with a more extended period.

In another article, Zaremba discovered that the long-short momentum strategy yields a significant negative return when using daily returns. A robust short-term reversal is implied in his research.

Do our findings support this reversal momentum?

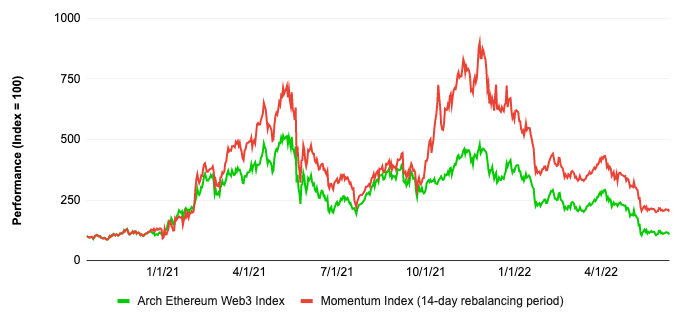

To explore the possibility of passively managed momentum/reverse momentum investing strategies, the team built a prototype momentum index based on the market-cap weighted WEB3 index.

The momentum index starts with the same token pool and weights as in the WEB3 index but adjusts the weighting of each token based on their relative past performance in the sorting window.

The general methodology assumes all returns are typically distributed and adjusts the weights using their z-score in the distribution.

From our findings, the momentum strategy works well in the short rebalancing period (14 days). Its monthly winning rate is 55%, meaning that the probability for momentum to outperform the market-cap weighted WEB3 index.

The average daily excess return over the WEB3 index is 0.00128, contributing to 59% annually.

However, this positive excess return gradually decreases and enters negative territory quickly. As the picture indicates, when the rebalancing period increases, the daily excess return drops significantly, indicating that the momentum anomaly fades away as the holding period increases.

For a rebalancing period of one month, the reverse momentum yields a positive excess return. Its monthly winning rate is 72%, and its daily excess return is 0.000237, which compounds to 9% annually.