GM Architects,

Markets are having one of their most difficult times in years. The S&P500 closed on Wednesday 18% below its early January peak. Nasdaq recorded its first five-week losing streak since 2012. In crypto, we witnessed carnage not seen in years following the collapse of the Terra ecosystem.

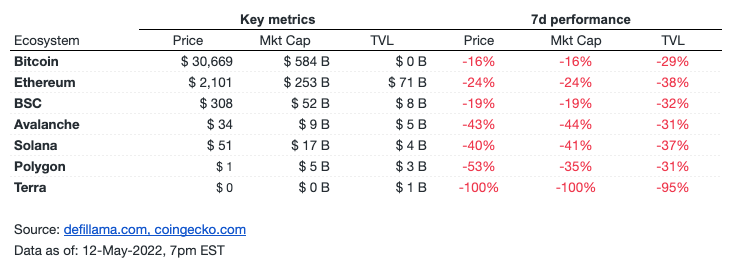

As it has been widely reported, algorithmic stablecoin TerraUSD (UST) lost its peg vs. the US dollar, triggering a 'death spiral' for the entire Terra-Luna ecosystem.

Terra came crashing down, hard. The ecosystem with the largest TVL after Ethereum went from a TVL of over $34B at its All-Time High to losing almost 95% in a matter of hours. The meltdown brought the price down to almost zero.

The broader crypto market lost 16% of its market cap yesterday. Bitcoin reached levels previously seen in December 2020. Ether traded 29% lower than last week.

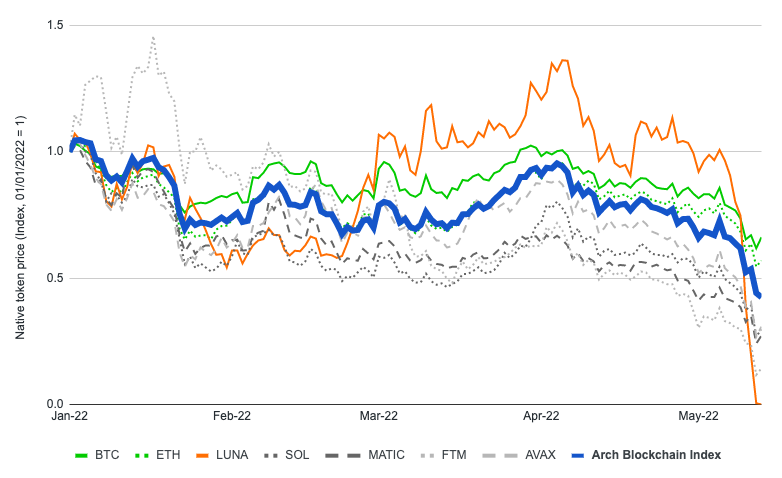

Some cryptocurrencies were less affected than others

Established networks like Ethereum and Bitcoin held up better than the newer so-called Ethereum killers, Solana and Fantom. Fantom's TVL dropped by 82% since ATH. Solana lost 37% of its TVL in just a week. Avalanche also lost over 31% of its TVL.

And while Ethereum also lost 38% of its TVL compared to last week, Ether's price only came down 24%, almost half of what Solana, now trading 40% lower, lost.

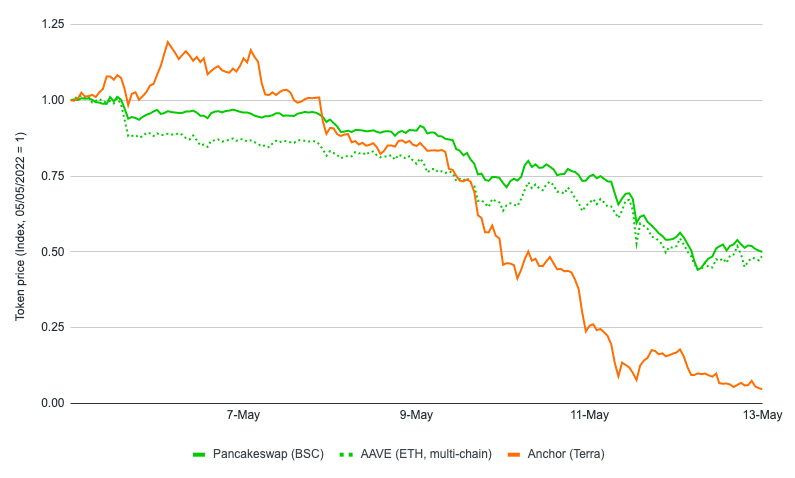

Future uncertain for Terra projects

Terra brought down several protocols with it, including Anchor, which saw its value drop close to zero, and tokens delisted from exchanges. We look forward to seeing these teams rise from the ashes.

Non-Terra protocols, including Ethereum projects like AAVE, and Binance projects like PancakeSwap, while still affected by the market movements, held up better.

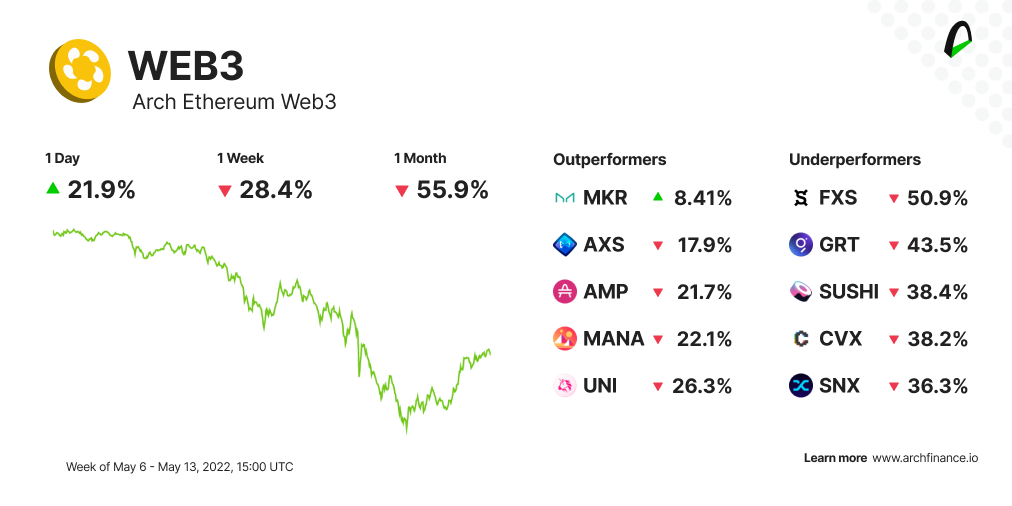

📉 Web3 falls in tandem with the rest of the market

The Arch Ethereum Web3 token also suffered during the market action.

- MakerDAO (MKR) was one of the least affected tokens as investors fled to more secure and established stablecoins like Dai and speculations over MakerDAO replacing Terra's dominance on DeFi grew. With LUNA falling more than 90% in the last 24 hours and the deppeged of some stablecoins, Dai has become the fourth largest stablecoin by market cap.

- Market makers were one of the most affected sectors during the Terra meltdown since most have a solid relation to UST through stablecoin liquidity pools. Curve (CVX) offered a large number of UST trading pairs.

- Frax Share (FXS) also felt the Terra pull. Having part of its treasury in stablecoins, including UST, the token is not trading oven 50% lower than last week.

- The rest of the tokens felt the market pressure, trading lower than the last week.

Ⓜ️ Learn more about Maker

MakerDAO is a decentralized organization built on Ethereum. It allows peer-to-peer borrowing and lending and has two different tokens MKR and the stablecoin DAI.

🔭 The importance of zooming out

When the markets are having rough weeks and experiencing bearish sentiments, investors feel the impulse to sell their assets.

However, it's essential to take a step back and remember this is not the first time crypto markets have tumbled.

Bitcoin lost over 80% of its value between 2018 and 2019, only to grow over 1.700% between 2019 and 2021.

Same with Ether. It's now trading close to $2.000 when only two years ago it was trading for just $200.

Let's use Ether's price chart as a reference. The results can be disheartening if you only see the seven-day chart.

Zoom out to a three month timeframe, and the price action doesn't look as bad.

And zoom out, even more, to the all-time chart, and you'll see how it's on an upward trajectory.

With a passive investment strategy, like the one we build on Arch, a long investing time frame protects investors from the ebbs and flows of volatile times like this one.

👁️🗨️ Become a beta tester

Be an essential part of Arch's development. We want to hear your feedback about a new prototype we are testing. Let's meet!

- $WEB3 holders - Verify your assets to access the exclusive #architects-lounge channel.

- 🐦 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- ⚠️ Important: beware of scams, and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

💼 Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.