GM Architects,

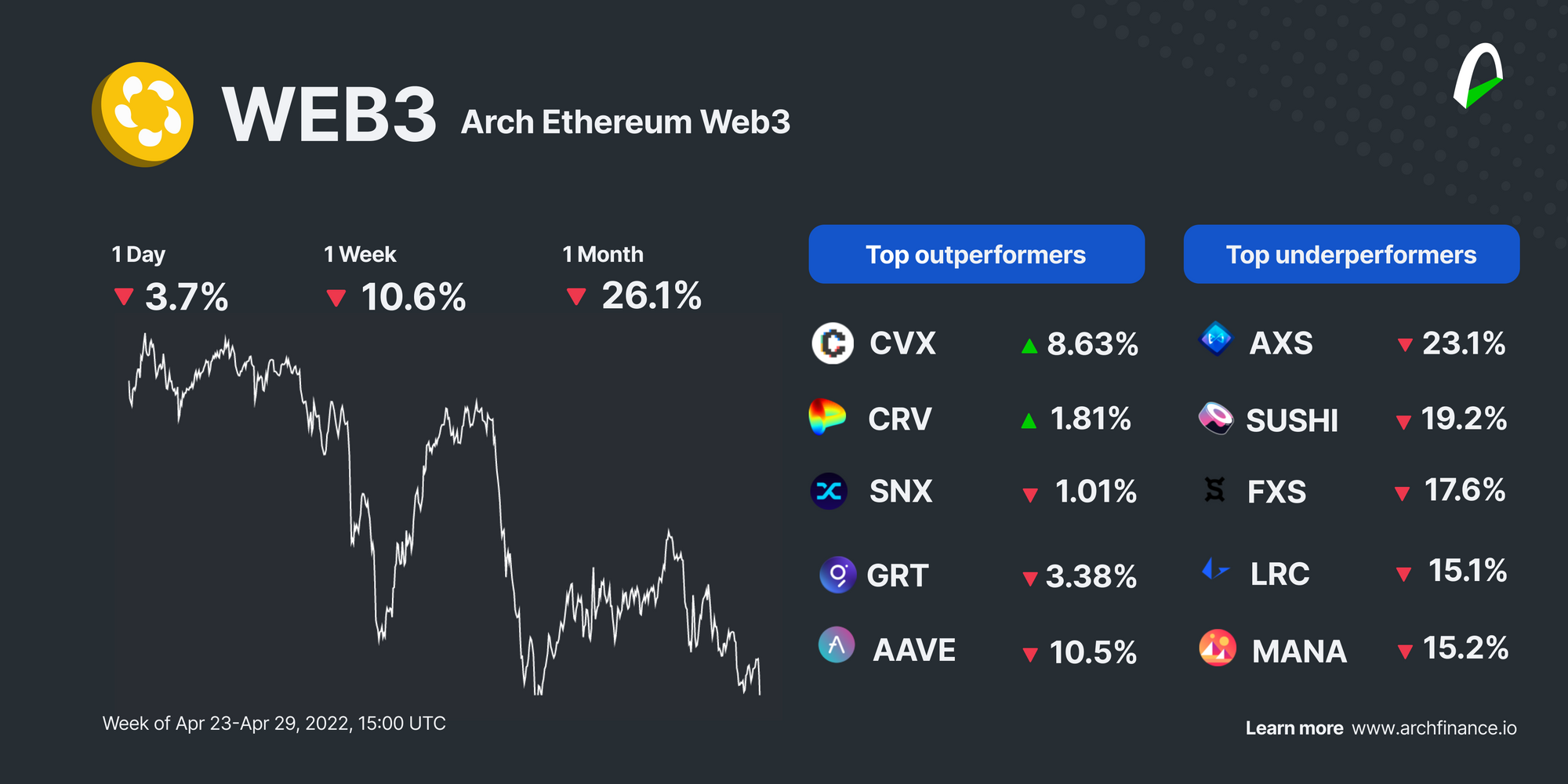

The Web3 market had another week in the red, and continues trending downwards this Friday afternoon.

Ethereum (ETH) was down 2.74%, while Bitcoin (BTC) was trading 2.40% lower than the last seven days.

Web3 protocol tokens were more affected than blockchain native cryptocurrencies, falling by 10.6%, a recurring theme in the past few weeks as investors flee to less volatile assets.

Rising inflation, the invasion of Ukraine, and the potential for tighter monetary policies have been affecting asset prices across the board. The stock market also experienced a tech-led sell-off earlier this week (following earnings results).

📉 DeFi tokens had difficult days amidst tech-led sell-off

- CurveDAO (CRV) is one of the few tokens in the green in the crypto space. CRV is seeing a solid investor inflow. This comes after launching a new staking pool with a gauge system that allows participants to get a share of the collected handling fees. This DEX is also at the top when it comes to Total value Locked (TVL), with more than $19B in TVL. CRR is also part of the Arch Exchange Index.

- Synthetix Network Token (SNX) was also one of the least affected by the volatility and uncertainty of the crypto market. Trading only 1.01% lower than the last seven days, SNX has seen an uptick in investors' interest after launching perpetual futures the previous week. SNX is also part of the Arch Derivatives Index.

- AAVE has been having a rough week, trading 10.5% down vs. last week. This week, AAVE founder, Stani Kulechov, was briefly suspended from Twitter after tweeting a joke about becoming Twitter's CEO. However, the token is seeing some buying pressure in the last couple of hours which could propel recoveries. AAVE is also part of the Arch lending Index.

- Axie Infinity Shards (AXS) is still feeling the impact of the $600M hack. AXS feels a solid bear push dragging the price to its nine-month low. From a technical standpoint, it is breaking down from its value area, showing that buyers are not interested in trading at that price, which can lead prices to lower even more. AXS is also part of the Arch Entertainment Index.

- Even Frax Share (FXS) broke its bullish trend. After days of trading in the green and the announcement of their Frax Share Pirce Index (FPI) token, FXS is now trading 17.6% below last week. FXS is part of the Arch Lending Index.

- Tokens that saw a good last couple of weeks, like Enjin Coin (EJN), were also affected by the volatility. EJN is trading on Friday, 14.9% down compared to the last seven days. EJN is part of the Arch Digital Property Index.

⚔️ Learn more about Synthetix

Synthetix (SNX) is a protocol built on Ethereum that enables the issuance and creation of synthetic assets.

It allows investors to get exposure to crypto and non-crypto assets while allowing them to interact with DeFi platforms without having to own DeFi assets.

Take a deep dive into Synthethix, and the SNX token that's part of the Arch Ethereum Web3 Token.

👁️🗨️ Become a beta tester

Be an essential part of Arch's development. We want to hear your feedback about a new prototype we are testing. Let's meet!

- $WEB3 holders - Verify your assets to access the exclusive #architects-lounge channel.

- 🐦 Join our community on Discord and follow Arch on Twitter.

- Stay tuned for events, research, and exciting product announcements.

- ⚠️ Important: beware of scams, and please report any attempts. We will not message you first and will never ask for your keys.

Contribute

Join the core team or become a contributor. We want to hear from you:

💼 Open positions:

Learn more about open positions and working at Arch. If interested, please send us a note on Twitter or Discord.

Disclaimer: The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations. The views reflected in the commentary are subject to change without notice.